Planning challenges for the changing paradigm of gas-powered generation operations

Joe Lane A * , Iain Rodger A , Andrew Garnett A B and David Close AA

B

Joe Lane is a Senior Research Fellow at the University of Queensland Gas & Energy Transition Research Centre (UQ-GET), leading the Centre’s Energy Security research theme. His research explores energy transition trade-offs from multiple perspectives, including the risks arising from interconnection across the electricity and gas systems. |

Iain Rodger is a Petroleum Engineer at UQ-GET focussed on reservoir simulation, and carbon capture and storage projects. Iain graduated from the University of Edinburgh with a BSc (Honours) in Chemistry with Environmental Chemistry, before completing an MSc in Petroleum Engineering at UQ. |

Andrew Garnett was the Centre Director at the UQ Centre for Coal Seam Gas and Centre for Natural Gas from 2012 to 2023. He is the current Chair of the Australian Gas Industry Trust. He has over 25 years of experience in international upstream conventional and unconventional oil and gas projects. |

David Close is the Director of UQ-GET, and has over 20 years of industry experience. He holds a PhD in Marine Geophysics from the University of Oxford and a BSc (Hons) from the University of Tasmania. |

Abstract

Gas-powered generation (GPG) will become increasingly critical for keeping the lights on in the east-coast electricity system (the National Electricity Market, NEM). However, energy transition planners still too often assume that GPG, and its gas supply, can continue being perfectly responsive to fluctuating electricity system demand. Multiple perspectives and historical experience suggest this is a poorly founded assumption. We illustrate the risks to NEM resilience, and the planning challenges for the gas sector, by implementing a deep-dive re-model of Australian Energy Market Operator’s (AEMO) 2024 Integrated System Plan (ISP-2024) Step Change scenario. Using AEMO’s own weather scenarios, the volatility in GPG demand will increase to levels far exceeding anything experienced historically in either the electricity or domestic gas supply systems. We also develop our own estimates of renewable energy zone (REZ)-level variable renewable energy (VRE) resource potential, back-cast over an 80-year historical record. This indicates that AEMO’s reliance on only 13 years of weather data is insufficient to capture the full range of possible winter wind production in southern states. This represents a substantial increase in the rate of gas supply (to GPG) that might be required, unanticipated by AEMO’s modelling approach. Infrastructure planning to support the coming energy transition, will need to pay far greater attention to the inherent uncertainty in estimates of future GPG demand.

Keywords: energy transition, gas powered generation, gas supply, GPG, NEM, renewable energy, uncertainty analysis, VRE.

Introduction

Gas-powered generation (GPG) has traditionally played a peaking role balancing supply and demand. The Australian Energy Market Operator (AEMO 2024a), state government (EY 2022) and independent (Simshauser and Gilmore 2024) planning studies make clear that this role becomes more critical as the share of variable renewable electricity (VRE) generation in the National Electricity Market (NEM) increases. The NEM already has substantial levels of VRE, sufficient to stimulate the economic withdrawal of coal-fired generators; and the winters of 2022 and 2024 expose the stress being created by increased system exposure to weather variability.

The historical notion of GPG being perfectly responsive has relied on gas supply being available onsite when it’s needed. While that may not have been a substantial challenge for NEM operations in the past, it’s clear that this can’t be taken for granted moving forward (ACCC 2024). As a pragmatic necessity AEMO’s Integrated System Plan (ISP) modelling maintains a scope limited to electricity system infrastructure; however, their assumption that GPG capacity and peak rates can grow with perfectly reliable gas supply contradicts their own assessments through the Gas Statement of Opportunities (GSOO) process.

We observe a tendency for electricity transition narratives to overlook the importance of gas supply planning. This paper describes one component of an initiative to explore planning challenges for both the electricity and gas sectors and the evolving interconnection between the two. Here we focus specifically on the influence of uncertain future weather variability and demand for gas supply to GPG.

Methods

The full suite of AEMO’s scenarios for the mid-century NEM transition are remodelled, with this paper focussing on the Optimal Development Path under the ISP-2024 Step Change scenario. The annual capacity and generation trends reported by the ISP are broken down into hourly dispatch sequences that are then used to explore how GPG operational dynamics might change over the 28-year scenario period.

The dispatch profiles are generated using a monolithic least-cost optimisation model, implemented in GenX (Bonaldo et al. 2025). Models calculate the supply profile necessary to meet the ISP’s 28-year demand scenarios, constrained by (i) the annualised Step Change infrastructure capacity trajectory; (ii) techno-economic assumptions for generators and storage from AEMO’s input, assumptions and scenarios report (AEMO 2024a); and (iii) hourly profiles of wind and solar generation taken from the ISP.

To focus directly on the connection between uncertain (future) weather variability and uncertain (future) GPG demand, the modelling assumes that: (i) all coal generators online in any given year (as per the ISP retirement schedule) are fully available for all hours of the year; and (ii) operation of electricity storage and hydro is socially optimal (not arbitrage-driven) with perfect weather foresight. These abstractions allow the weather-GPG dynamics to be isolated, but mean that our results will tend to underestimate overall GPG usage.

The NEM modelling is combined with our own assessment of resource potential for the future VRE fleet, modelling wind and solar generation for each designated renewable energy zone (REZ). That VRE modelling was tailored to statistically match AEMO’s published REZ-level capacity factor (CF) traces, then back-cast to 1940 using the ERA5 gridded reanalysis (historical climate) model. The 80-year timeseries is used to assess whether AEMO’s 13-year reference period (2010/11 to 2022/23) adequately reflects the weather uncertainty that could affect demand for GPG.

Results and discussion

The GPG operational paradigm is changing

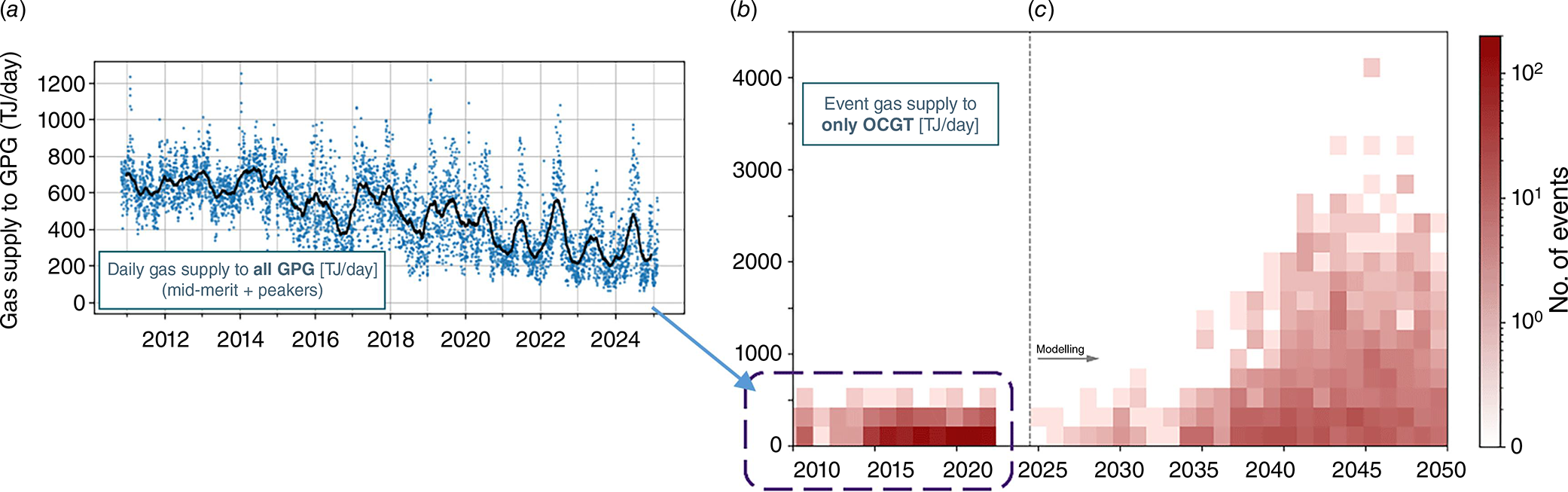

Fig. 1 illustrates the anticipated stark change in GPG operations in the ISP’s Step Change scenario. Although aggregate historical demand is trending down, the decline in peak daily demands is muted, and the ratio of peak:average demands has increased substantially (Fig. 1a). Furthermore, from 2019, there has been a shift from summer- to winter-dominated peaks, with the 2022 and 2024 winters illustrating how strongly the seasonal demand can spike.

(a) Historical trend of NEM-wide GPG activity, in terms of daily gas supply demands. (b) Peaker plant data only characterised in terms of discrete events. (c) Forward-looking results from our re-model of the ISP-2024 Step Change scenario, using one specific weather-scenario. GPG, gas-pPowered generation; OCGT, open-cycle gas turbine.

Fig. 1b isolates the peaker-only (daily) demands of up to ~550 TJ/day. The heat map provides a distribution of event sizes for each year, based on each event’s peak 24 h demand for gas. That same representation is then applied to the GPG peaker fleet in the ISP scenario, showing that the annual distribution of sporadic daily gas demands spreads substantially into the future, with the largest demands (max gas supply rate) growing seven-fold.

The infrastructure planning process should explicitly account for GPG demand uncertainty

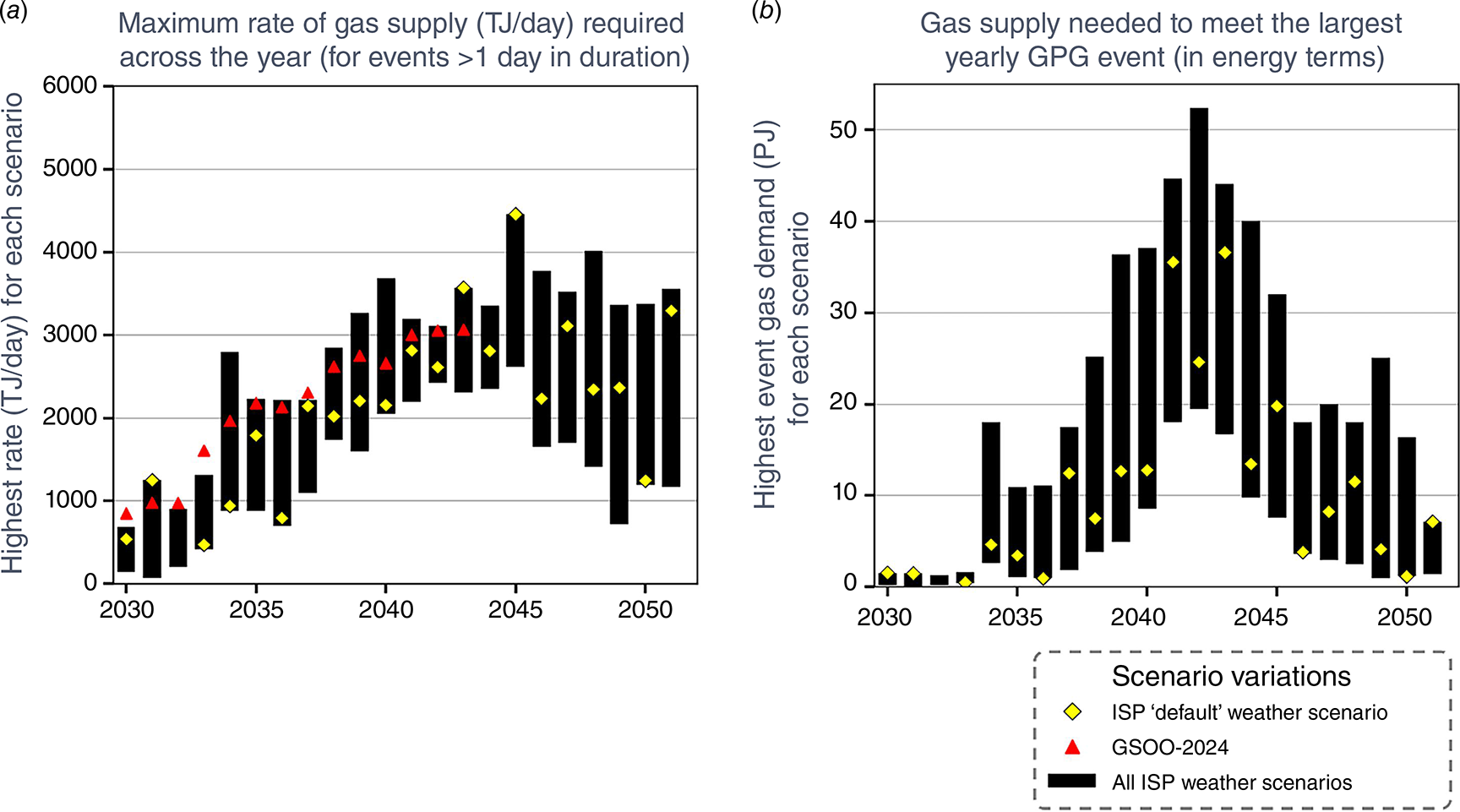

The results presented in Fig. 1c are from our remodel of one specific weather scenario used by AEMO for modelling the ISP (also used for their short-medium term Electricity Statement of Opporunities and GSOO risk assessment processes). The equivalent result for the entire GPG fleet is shown as the yellow points on Fig. 2a, expressed as the largest daily rate of gas supply required for any event in a given year.

Largest annual gas supply events to meet GPG demand for the ISP-2024 Step Change scenario – showing how that scale varies (spread of the black bar) depending on which ISP weather scenario is used. (a) The annual maximum 24 h supply rate (TJ/day); (b) the maximum supply volume required (PJ) for any event in that year.

Our analysis was also applied to the 13 other weather scenarios used for the ISP development, holding all other model inputs the same (Fig. 2a). For each year in the ISP timeline, the black bar shows how much that maximum daily gas supply rate varies, depending on which scenario for future weather variability is used. The upper limit of those annual spreads is broadly consistent with the equivalent values reported in the GSOO-2024 (AEMO 2024b).

The change in trend from the 2040s is also apparent in Fig. 2b, which shows the equivalent analysis of the largest events in terms of total gas (PJ) required. The increased spread in maximum supply rate and declining peaks in total event energy demand from that point, suggest that the ongoing growth in VRE generation and (electricity) demand-side change start to fill big parts of the VRE shortfall, that in prior years might have required major supply from GPG.

More extensive weather uncertainty analysis will be crucial

In this modelling, the majority of the largest GPG events occur in winter are driven primarily by shortfalls in the southern states wind resource. This is consistent with other studies (Boston et al. 2022; Gilmore et al. 2022).

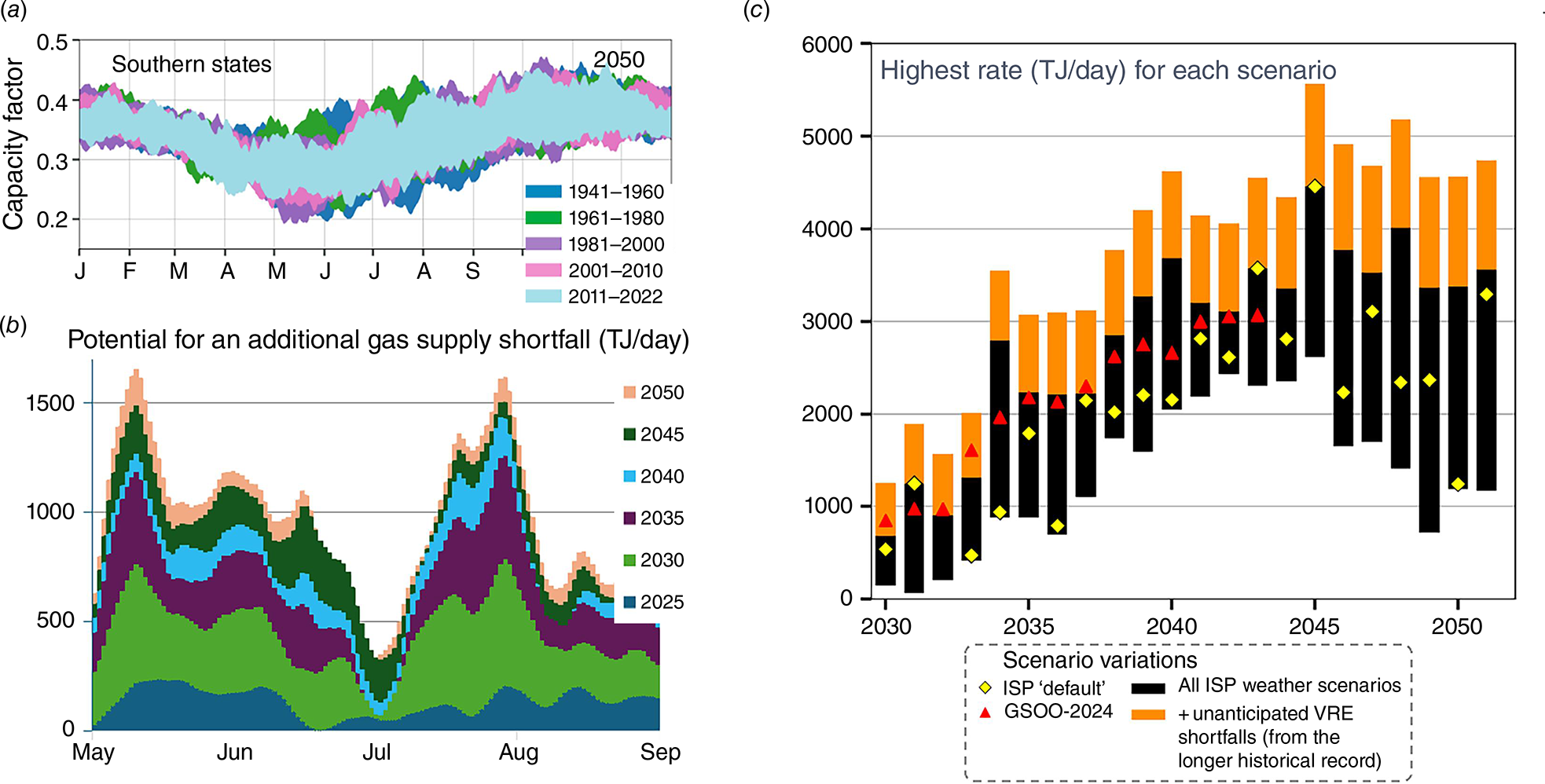

Fig. 3a illustrates that AEMO’s 13-year reference period doesn’t capture the full downside of winter VRE resource potential at a fleet level. The spread below the light blue band (2011–2022) indicates that the 30d-means in earlier periods would have had lower lows in VRE resource potential – this represents a potential electricity supply shortfall not anticipated by AEMO’s ISP. Only in July does the ISP reference period capture the lows in wind and solar resource that exist in the 80-year historical record.

Potential implications of considering a longer historical weather record than assessed by AEMO. (a) Thirty-day (30d)-means of our modelled fleet-wide VRE resource potential, for the 4× southern NEM states (NSW, Vic, SA, Tas). The light blue band shows the seasonal profile of how that 30d-mean capacity factor (CF) varies across the AEMO focal years (2011–2022) – this version for the ISP Step Change capacity mix in year 2050. Other colours show how much that spread increases, as the historical record is lengthened. (b) Measures the difference, at any point in time, between the low point of fleet CF if the full 80 years are considered, instead of just the 2011–2022 period – expressed as the gas supply that would be needed to make up for that unanticipated shortfall. (c) Repeats the Fig. 2a modelled results (black) for all states including Queensland; also illustrating (orange) the potential for higher required gas supply rates if a longer historical record of weather is incorporated into the uncertainty analysis. For the latter, orange bars represent the 75th percentile of the winter shortfall analysis illustrated in (b).

That lower winter VRE generation potential in older decades, suggests AEMO’s reliance on a limited number of weather years could underestimate peak demand for GPG during winter. Fig. 3b shows how the scale of this unanticipated shortfall changes through the Step Change transition, growing substantially as the NEM’s reliance on VRE grows.

Fig. 3c superimposes that additional VRE winter resource shortfall risk, onto the GPG-event results from our NEM remodel. The orange bars are sized at the 75th percentile of the 30-day-mean shortfalls (Fig. 3b) over the winter months (May–August). This illustrates the potential implications for electricity system risk and gas supply planning, if the timing of one of these unanticipated VRE resource shortfalls coincided with GPG being required to act as the ‘option-of-last-resort’ to maintain electricity supply to the NEM.

Conclusions

The relationship between future weather variability, and future demand for gas supply to GPG, warrants priority concern for both the electricity and gas sectors. For GPG to continue as a reliable option-of-last-resort for maintaining the NEM supply-demand, major investment will be needed into GPG facilities, midstream infrastructure and upstream gas supply. However, the inherent uncertainty over future weather variability translates to substantive differences in the estimate of how much gas supply and infrastructure might be needed. A more dedicated focus on the uncertainty over future GPG demand will be required, if Australia is to successfully navigate the coming energy transition.

Data availability

Final data compilations will be shared upon reasonable request to the corresponding author.

Declaration of funding

This research was funded by The University of Queensland Gas & Energy Transition Research Centre and its industry members (APLNG, Arrow Energy, and Santos), and the Australian Gas Industry Trust.

References

Bonaldo L, Chakrabarti S, Cheng F, et al. (2025) GenX (Version 0.4.4) [Computer software]. 10.5281/zenodo.10846070

Boston A, Bongers GD, Bongers N (2022) ‘Characterisation and mitigation of renewable droughts in the Australian National Electricity Market’. Environmental Research Communications 4(3), 031001.

| Crossref | Google Scholar |

Joe Lane is a Senior Research Fellow at the University of Queensland Gas & Energy Transition Research Centre (UQ-GET), leading the Centre’s Energy Security research theme. His research explores energy transition trade-offs from multiple perspectives, including the risks arising from interconnection across the electricity and gas systems. |

Iain Rodger is a Petroleum Engineer at UQ-GET focussed on reservoir simulation, and carbon capture and storage projects. Iain graduated from the University of Edinburgh with a BSc (Honours) in Chemistry with Environmental Chemistry, before completing an MSc in Petroleum Engineering at UQ. |

Andrew Garnett was the Centre Director at the UQ Centre for Coal Seam Gas and Centre for Natural Gas from 2012 to 2023. He is the current Chair of the Australian Gas Industry Trust. He has over 25 years of experience in international upstream conventional and unconventional oil and gas projects. |

David Close is the Director of UQ-GET, and has over 20 years of industry experience. He holds a PhD in Marine Geophysics from the University of Oxford and a BSc (Hons) from the University of Tasmania. |